The F Word

In the world of finance and accounting, every detail matters. There’s absolutely no wiggle room for error. But there also aren’t enough hours in the day to do everything that needs to get done. That means finance teams often have no choice but to deprioritize more meaningful (and enjoyable) strategic initiatives.

One of our goals at Retained Learnings is to help finance professionals get ahead of this dynamic and gain more control over their careers as a result. Throughout 2022, we’ve been conducting research with a focus group to better understand common pain points and time sinks. An issue that inevitably comes up is expense management, particularly in remote work contexts.

To help explore this issue in greater depth, we commissioned a survey of 427 Canadian finance decision makers at companies with 15-300 employees. All respondents were members of the online Angus Reid Forum. Here are some key findings.

Finance leaders are increasingly focused on tracking spend and finding opportunities for cost savings. Unfortunately, the reality is that much expense management is done retroactively after the expenses have been incurred.

It’s common for business expenses to be incurred on credit cards, and yet this is an area of spend that is rife with operational bottlenecks.

Of note:

Whether an employee is traveling for a conference or picking up supplies for a virtual social, most companies are expecting the employee to outlay this expense on their personal credit card and get reimbursed in the future.

Why is this a problem?

As companies look to conserve cash, employee headcount is under extra scrutiny. Finance departments must evaluate all expenses with a critical eye, and look for ways to support the business without hiring new staff.

Expense management is an area that traditionally involves a high degree of manual data entry and time-consuming repetitive tasks.

Security and fraud risks are rising across the board. The best way to address these challenges is to address and identify potential issues head-on, before they have a chance to bubble up. Here are some of the problem areas that came up in our research.

Virtual socials, work from home stipends, the list goes on. As companies increasingly moved to a remote or hybrid workforce during the Covid pandemic, this resulted in new or more pronounced issues around expense management.

The most time-consuming expense reporting tasks for companies that have shifted to remote work are: ensuring expenses are accurate (64%), fixing human errors (56%), tracking down employees for receipts (56%) and manually reconciling and entering data (55%).

Final Thoughts

The ripple effect of heavy manual expense tracking is that it leaves businesses unable to scale up without increasing overhead. It’s important to tackle expense management issues as early on as possible. Take a look at the full report to help with identifying issues that may be impacting your organization.

[Embed code from here: https://floatcard.com/new-survey-reveals-pain-points-in-spend-management/]

Methodology: These are the findings of a survey conducted by Float from May 26-30, 2022 among a nationally representative sample of 427 Canadian finance decision makers at companies with 15-300 employees. All respondents were members of the online Angus Reid Forum. For comparison purposes only, a probability sample of this size would yield a margin or error of +/- 4.7 percentage points, 19 times out of 20. The survey was offered in both English and French.

Ongoing layoffs. Rumblings about a storm coming ahead with the IPO market at its worst. Trends like Canadian VC funding hitting an all-time high. Discussions of a potential recession. There’s understandably a lot of confusion. How do we make sense of it all? What does it take to be a successful company in this unpredictable market? How can companies prepare?

Retained Learnings reached out to a group of Canadian venture capitalists (VCs) for their expert insights on how founders and finance leaders can best navigate these questions. Here are some highlights from our interviews:

Eliminate the noise, reexamine what your company needs now to grow, and stay focused on the outcome.

“In challenging environments like these, a ruthless focus on the thing that matters most for the business is required to succeed. What is the one thing you need to get right in order to win? Apply all your resources and energy to that thing, and tune everything else out because it’s noise.”

Gideon Hayden

Managing Partner, Leaders Fund

Cash flow is always foundational, but in this market, it has taken on new meaning.

“Our advice to founders in this environment has two approaches. The first is to make time your friend by ensuring enough cash runway exists to enable businesses to succeed, and the second is more nuanced depending on the sector or company. In markets where growth is accelerating, we are telling our founders to seize the opportunity. In those cases where growth is slowing, we are asking them to focus on efficiency and finding gritty ways to grow. A one-size-fits all advice policy isn’t always appropriate. Your customers should be telling you how you are doing.”

Peter Misek

Founder & Managing Partner, Framework Venture Partners

Take stock of what opportunities can accelerate your growth or productivity. Make tough calls to reduce the impact of headwinds.

“If you provide your customers with real and immediate productivity tools or mission-critical applications, this investment may become a tailwind for your business. You will have opportunities to gain market share, innovate, and accelerate your growth. It is during recessions that Google and Facebook have emerged as leaders. So there! It’s not all bad news.

If you are in a tailwind situation, this is surely a good time to accelerate your product agenda, or even buy a competitor if you happen to be blessed with a sufficient pool of resources. Understanding your competitor’s cash and competitive position, as well as your own, will be more important than ever.

In contrast, if a recession sends headwinds your way, it is crucial for you to have the courage to recognize your position and make tough decisions. Only then will you buy the option to make it through to see the next up cycle.”

Magaly Charbonneau

Partner, Inovia Capital

Understand that the details matter. Now is the time to be more intentional about the small details that have the potential to scale up.

“There’s a misconception about a trade-off that exists between focusing on growth at all costs, and profitable growth, because doing both a little bit often doesn’t work super well. You should always be steering a tight ship.

Consider every dollar spent as an experiment that requires justification for continued investment. Measure everything and you’ll know exactly where to double down. Is there low-hanging fruit optimizing conversion rates? Can you reduce customer acquisition costs (CAC) with viral product strategies? Lengthen long-term value (LTV) with customer success or re-engagement campaigns? How do you justify a new full-time salary?

Growth leadership during an economic downturn isn’t just about go-to-market, it’s a full-company effort. Capital is best raised if you know exactly how to spend it.”

Katheleen Eva

Venture Capital Investor, StandUp Ventures

Remember that success is a spectrum. Balanced thinking has the potential to be your company’s competitive advantage.

“You’re certainly not going to win in raising capital just by showing that you’re profitable but not growing. And then on the flip side now, I don’t think you can just be growing and not demonstrate some level of potential for a profitable, healthy unit economic business. So you have to find the middle ground of, you know, really strong growth and proof points around your unit economics. Now, this always depends on stage and the type of business, but it’s finding that middle ground.”

Matt Golden

Founder and Managing Partner, Golden Ventures

As shared in the Retained Learnings podcast, episode airing October 13th

As the saying goes, we can’t change the world around us — but we can take action to ensure that we are optimally prepared. Every business has its own unique story, and it’s up to finance leaders to support leadership in making the right judgment calls. Now more than ever, founders, executive teams, investors, and finance teams need to be working closely together to ensure the best possible outcomes for their organizations. The bottom line is to never underestimate the power of self-stability as a force of forward progress.

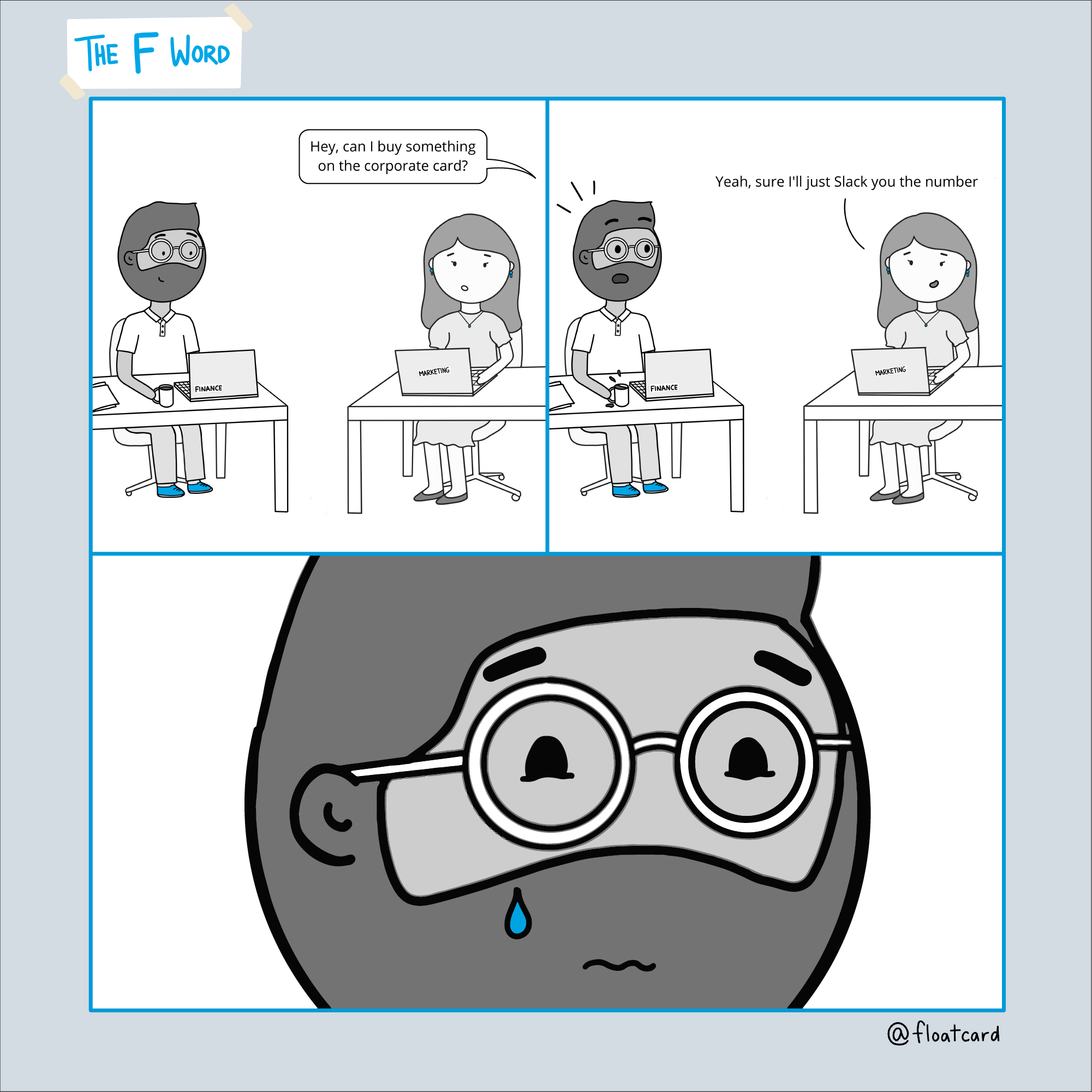

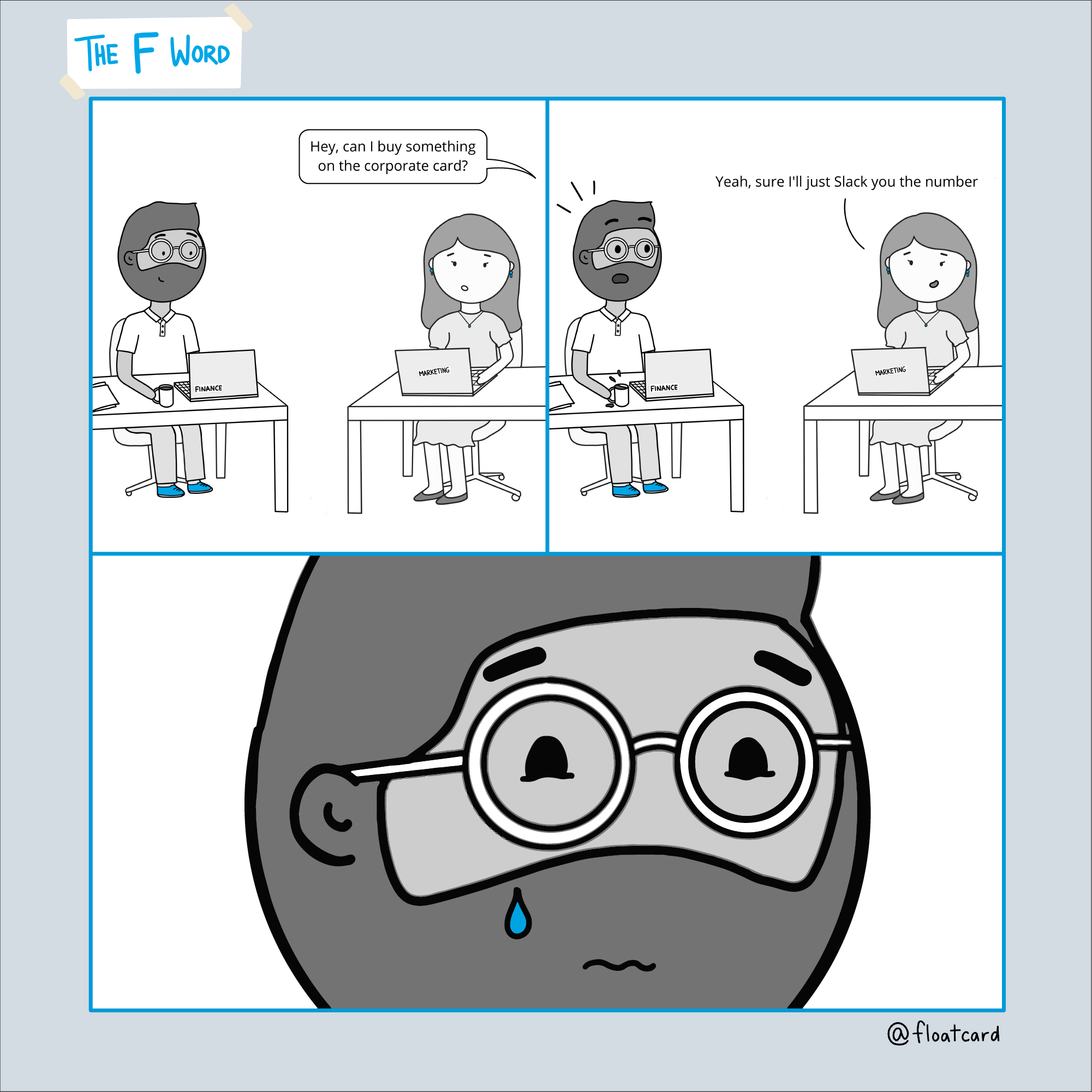

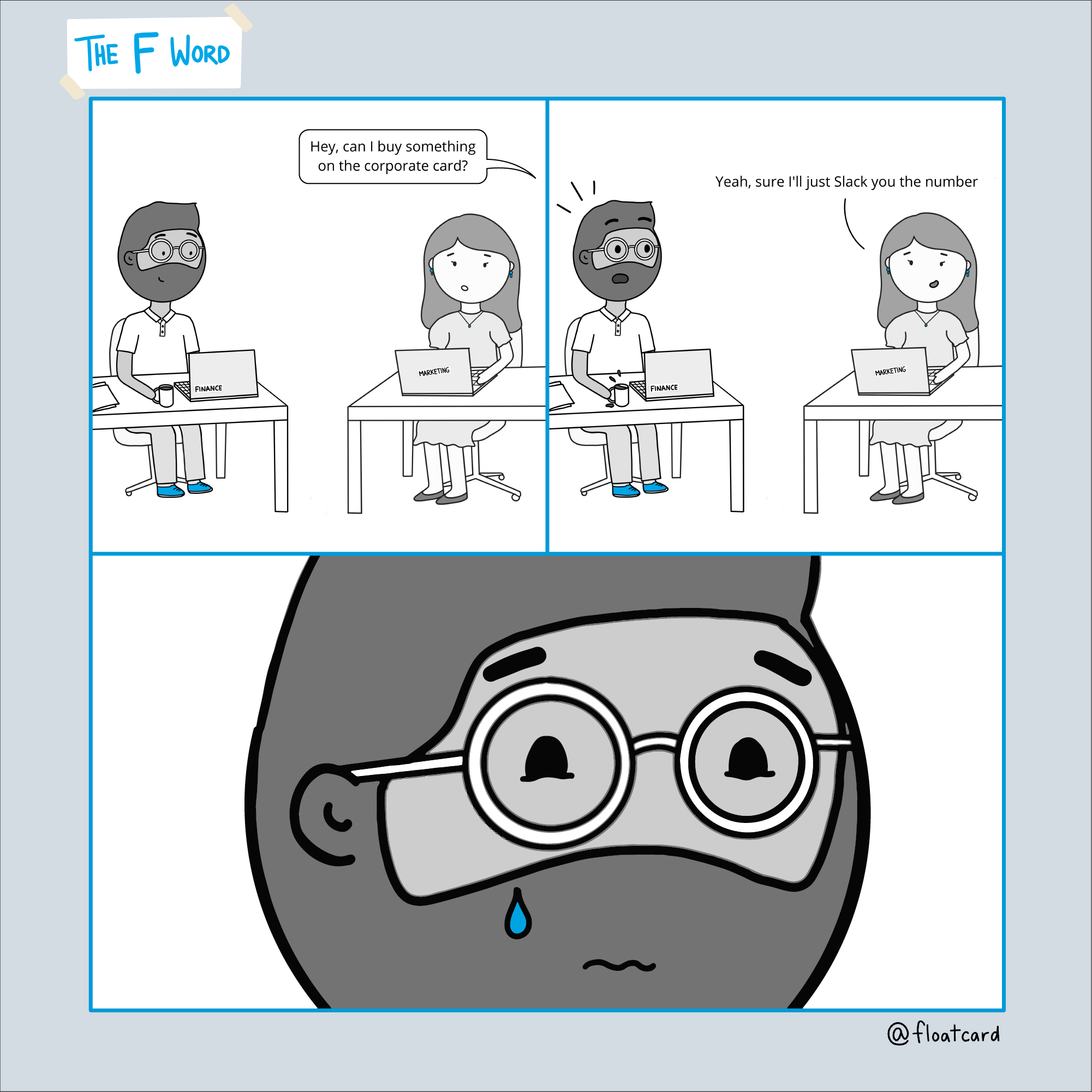

Introducing The F Word, a new comic that puts the spotlight on the inner workings of the finance department. Whether it’s chasing employees for receipts or nerding out on Excel jokes, we’ll show you that finance isn’t as dry as people think. If Dilbert and The Office had a baby, and that baby was really good with numbers, it would be The F Word.

Have a funny finance anecdote to share with us? Let us know by Tweeting @floatcard .